Indian Machine Tool Industry

Indian Machine Tool Industry

The upcoming Union Budget 2024 has generated significant interest in the machine tool sector, with stakeholders eagerly anticipating policies that could strengthen the industry. Here’s what the industry typically seeks:

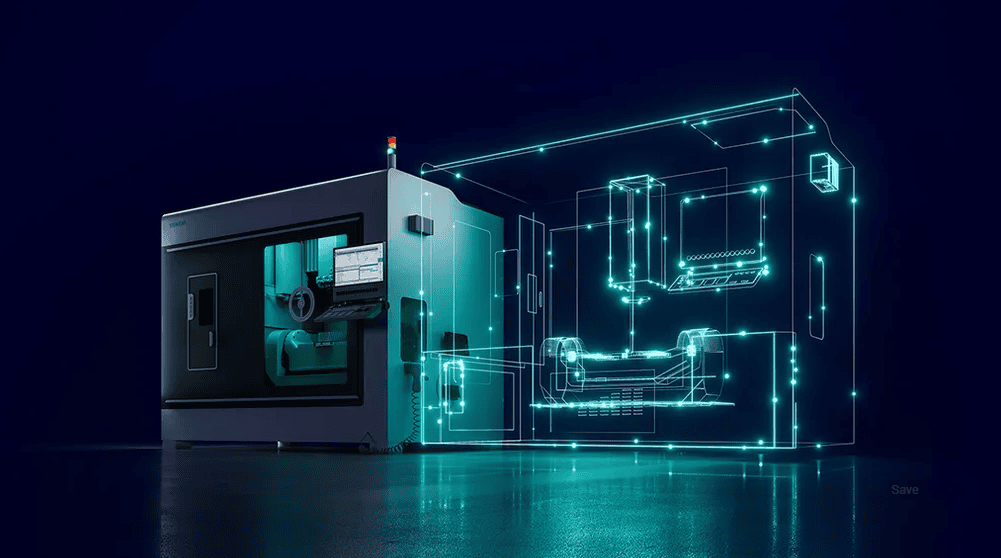

1. Enhanced Capital Investment Incentives

Capital investments are essential for machinery and technology upgrades. The industry expects tax reliefs and incentives to make these upgrades more affordable, boosting productivity and global competitiveness.

2. Focus on Skill Development

With the demand for skilled labor growing, increased government investment in technical training programs would benefit the machine tool sector, addressing the current skills gap and preparing workers for advanced machinery operations.

3. Support for Research and Development

Innovative technology requires dedicated R&D efforts. Tax exemptions or grants for companies engaged in R&D would help drive advancements in automation, efficiency, and sustainability within the industry.

4. Policies Favoring Domestic Manufacturing

Incentives that prioritize local manufacturing of machinery and tools can strengthen the industry’s supply chain and reduce dependency on imports, aligning with the government's "Make in India" vision.

5. Environmental and Energy Efficiency Initiatives

With rising concerns around sustainability, policies promoting energy-efficient machinery, waste reduction, and greener manufacturing practices are increasingly critical. Subsidies or tax deductions for adopting sustainable technologies would be welcomed by the industry.

As we await the Union Budget 2024, these areas represent some of the key priorities that could propel the machine tool industry forward. Policies addressing these aspects could boost the sector’s contribution to India’s economic growth and global competitiveness.